SINGAPORE (21 MARCH 2017) – Mapletree Investments Pte Ltd (“Mapletree” or “the Group”) has successfully closed Mapletree Global Student Accommodation Private Trust (“MGSA P-Trust” or “the Trust”), the first trust in Singapore that focuses on this resilient and strong-yielding sector.

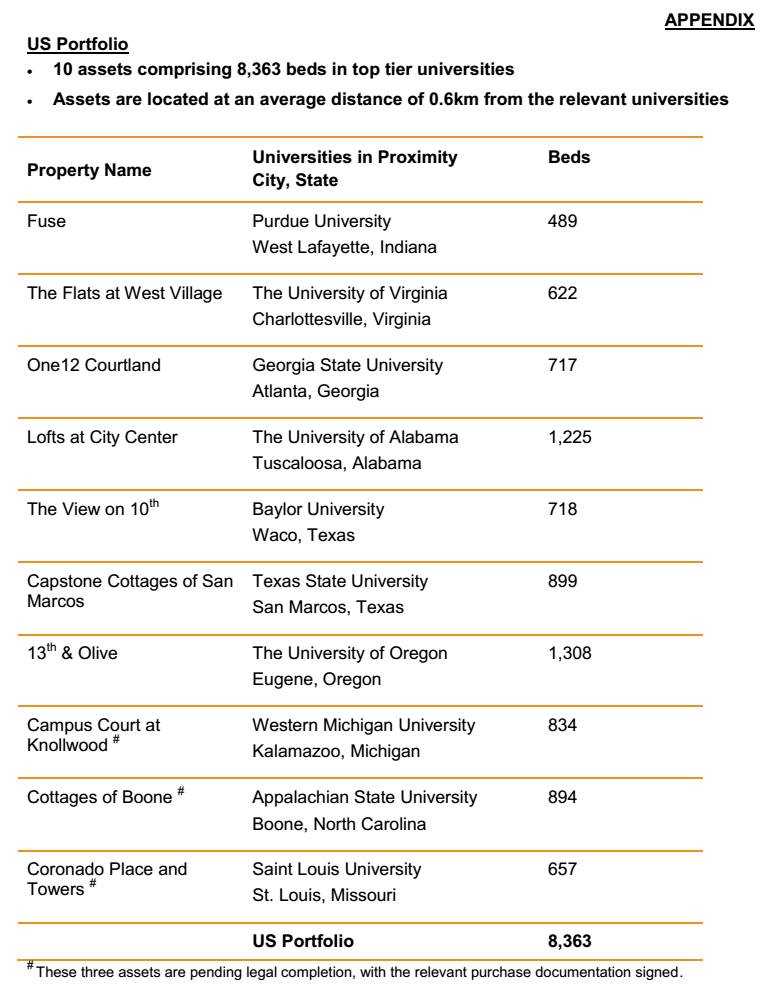

MGSA P-Trust holds about US$1.3 billion in student accommodation assets located in the United Kingdom (“UK”) and the United States (“US”), the two largest student accommodation markets in the world. About GBP195 million of equity was raised for the 5,910-bed UK portfolio and US$291 million for the 8,363-bed US portfolio (please refer to the appendix for the list of properties and their locations)[1]. The Trust has a term of five years (with provision for a one-year extension).

The Trust is managed by Mapletree Real Estate Advisors Pte. Ltd., a wholly-owned subsidiary of Mapletree. To strongly align investor-manager interests, Mapletree will retain a 35 per cent stake in MGSA P-Trust, within the range of stakes it has taken in its other sponsored funds/trusts. Major participating investors include The Great Eastern Life Assurance Company Limited, as well as DBS Bank and UBS AG, who are investing in the Trust on behalf of their high net worth clients.

Said Mr Hiew Yoon Khong, Mapletree’s Group Chief Executive Officer: “The successful close of MGSA P-Trust is testament to investors’ confidence in Mapletree’s track record of delivering the desired returns levels. Opting for the private track also allowed us to bring the product to market quickly, and is more cost effective to set up and operate on an ongoing basis, without the lengthy process to launch an IPO and the increasing compliance costs to maintain a REIT."

Mr Hiew added, “Mapletree will continue to develop innovative real estate investment products that cater to the varying investment needs and risk-return profiles of investors. In the case of MGSA P-Trust, investors will be able to reap strong returns from an asset class proven to be relatively anti-cyclical in nature, with the pursuit of higher education growing worldwide even during economic downturns. The US and the UK, homes to the largest number of top universities in the world, are key beneficiaries of this trend. Investors of MGSA P-Trust will therefore benefit from the robust and stable income of the assets, which will be distributed to them along similar principles as a Singapore-listed REIT.”

MGSA P-Trust’s target yield is in line with the four Mapletree-sponsored listed S-REITs. Distributions will be paid on a semi-annual basis in GBP (for the UK assets) and US$ (for the US assets).

<END>

MEDIA CONTACTS

Eileen Lee

Manager

Corporate Communications

Mapletree Investments Pte Ltd

Direct: +65 6659 3669

Mobile: +65 9786 4946

Email: eileen.lee@mapletree.com.sg

ABOUT MAPLETREE

Mapletree is a leading real estate development, investment and capital management company headquartered in Singapore. Its strategic focus is to invest in markets and real estate sectors with good growth potential. By combining its key strengths as a developer, an investor and a capital manager, the Group has established a track record of award-winning projects, and delivers consistent and high returns across real estate asset classes.

Mapletree currently manages four Singapore-listed real estate investment trusts (REITs) and five private equity real estate funds, which hold a diverse portfolio of assets in Singapore and Asia Pacific.

As at 31 December 2016, Mapletree owns and manages S$38.6 billion of office, retail, logistics, industrial, residential, corporate housing and serviced apartment, and student housing properties.

The Group’s assets are located across 12 economies globally, namely Singapore, Australia, China, Germany, Hong Kong SAR, India, Japan, Malaysia, South Korea, the United Kingdom (UK), the United States (US) and Vietnam. To support its global operations, Mapletree has established an extensive network of offices in Singapore, Australia, China, Hong Kong SAR, India, Japan, Malaysia, South Korea, the UK, the US and Vietnam.

In the US, Mapletree currently owns a portfolio of seven student accommodation assets with close to 6,000 beds across six states (and is in the process of acquiring another three assets that will add over 2,000 beds), as well as eight Oakwood-branded corporate housing properties with more than 1,200 units. The corporate housing properties are situated in Silicon Valley, Raleigh, Los Angeles, Portland, Dallas and Seattle.

In the UK, Mapletree currently owns office assets such as the Diageo Headquarters in West London, 3 Hardman Street in Manchester, iQ Building in Aberdeen and One Glass Wharf in Bristol. It also acquired Green Park, a 79-hectare business park in Reading, Berkshire. It also has a portfolio of 25 student accommodation properties that provides close to 6,000 beds across 12 core university towns such as London, Edinburgh, Birmingham and Liverpool.

For more information, please visit www.mapletree.com.sg.